1. OVERVIEW

In July 2023, the former UK Chancellor of the Exchequer, Jeremy Hunt, announced the “Mansion House Reforms” which called for UK Defined Contribution (DC) pension schemes to allocate 5% of their default funds to unlisted equities by 2030. Following the UK election in July, the new Chancellor Rachel Reeves, has announced a major review of the pension fund industry, with the stated aim of:

- Unlocking additional capital for high-growth UK private companies.

- Boosting retirement income for UK workers by tapping into the higher returns that asset classes such as venture capital can provide.

Over the last 25 years, the global VC industry has generated an annualised return of 16.5%. This compares to just 9.1% for the S&P 5001. It is clear that a well-managed VC programme could be significantly beneficial for UK pension funds. However, we do have concerns that the government is trying to find a single solution to two, ultimately separate, problems. In particular we would highlight four areas that must be carefully considered:

- There is no shortage of investment capital for the best companies in the UK. However, the UK lags significantly behind the US when it comes to scaling and exiting these businesses.

- UK venture capital funds have historically underperformed their US counterparts when it comes to delivering realised returns to investors.

- Venture capital is a “power law” asset class. Returns are driven by just a handful of companies each year. The vast majority of these companies are located outside of the UK.

- The dispersion of returns within venture capital is

‘Source: Cambridge Associates Venture Capital Index and Benchmark Statistics. Data to 31 UK companies raised a higher percentage of capital at March 2024. S&P 500 return calculated as a modified PME.

2. UNLOCKING CAPITAL

In announcing the review of the pension industry, Rachel Reeves highlighted that an investment shift in DC schemes could deliver £8 billion of investment capital into the UK economy. In addition, the government is also looking at how to unlock the £360 billion held in Local Government Pension Schemes (LGPS) to make it an “engine for UK growth”.

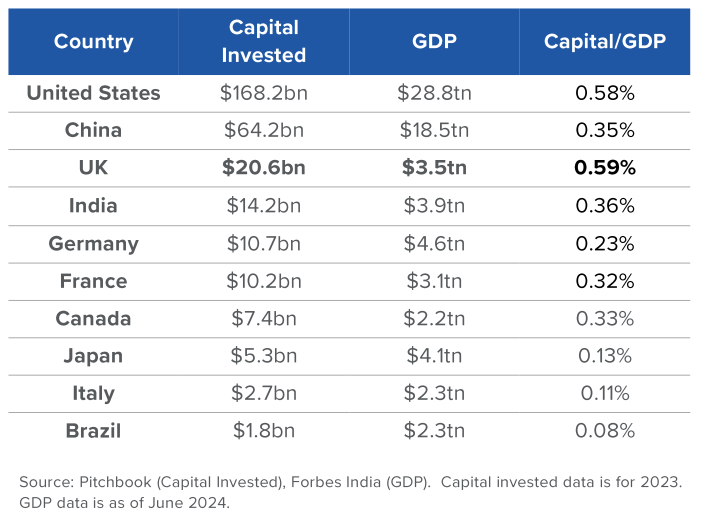

This suggests that one of the main challenges facing UK companies is an undersupply of capital. However, as shown in Figure 1 below, UK VC-backed companies rank third globally in terms of total capital raised, with only the US and China exceeding the $20.6 billion raised by UK companies in 2023. In addition, when compared to the size of their respective economies, UK businesses are materially outperforming their global peers in raising VC capital. Investment in UK VC- backed companies in 2023 represented 0.59% of the UK’s GDP. This is higher than the US and China and nearly double the nearest European competitor.

Figure 1: VC Investment vs GDP

One of the arguments made to counter this data is that while the UK may have plenty of startup capital, it suffers from a lack of growth capital. This means that while companies may receive the financial support they need in their first few years, there is a dearth of investment available for more mature businesses.

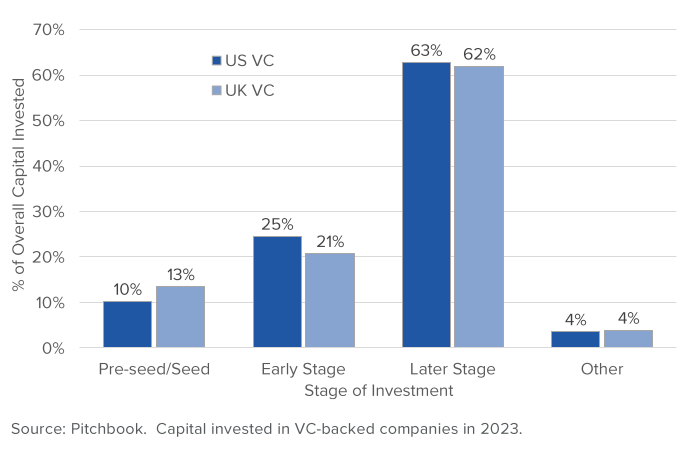

Figure 2 below shows the respective proportion of capital invested by stage of company in 2023. While UK companies raised a higher percentage of capital at the very earliest stages (pre-seed and seed), there was virtually no difference in the percentage invested in later-stage companies.

Figure 2: No Shortage of Growth Capital

Overall, the funding data delivers a very clear and consistent message. There is no shortage of startup and expansion capital available to the best UK companies. Any increase in funding to UK companies must be driven by the quality of the investment opportunities being created. We have seen many times in the VC industry that a sudden influx of capital into a market doesn’t create additional value for investors. It typically destroys it. An oversupply of funding results in higher entry valuations, too many marginal companies being founded, a lack of capital efficiency at these businesses and, ultimately, disappointing returns.

Over the long term, capital will flow to those areas that offer the best risk-adjusted returns. If the UK VC industry wants to attract more investment, then it must deliver returns that are comparable to the performance investors have been able to achieve in other geographies.

3. DELIVERING RETURNS TO INVESTORS

Sequoia Capital, arguably the most successful venture firm in the industry, believes that there are only two numbers that really matter when it comes to venture capital—how much you have paid in and how much you have received back.

While UK companies have been successful in attracting investment, they have struggled to turn this capital into realised returns.

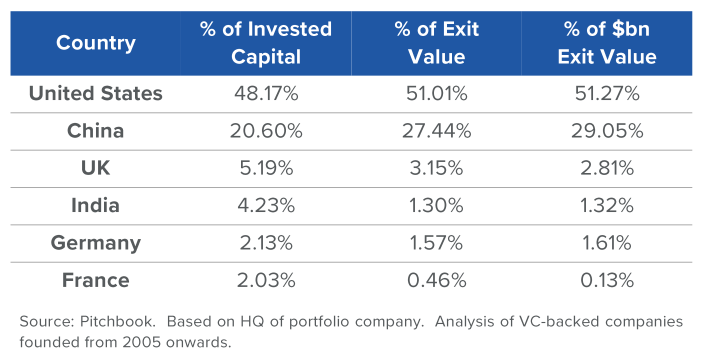

Figure 3 below shows that despite UK companies raising over 5% of the capital invested in VC-backed companies globally, they only account for just over 3% of the exit value created. And this falls to just 2.8% of the value that comes from the very largest exits —those at $1 billion or higher.

Figure 3: Where VC Value is Generated

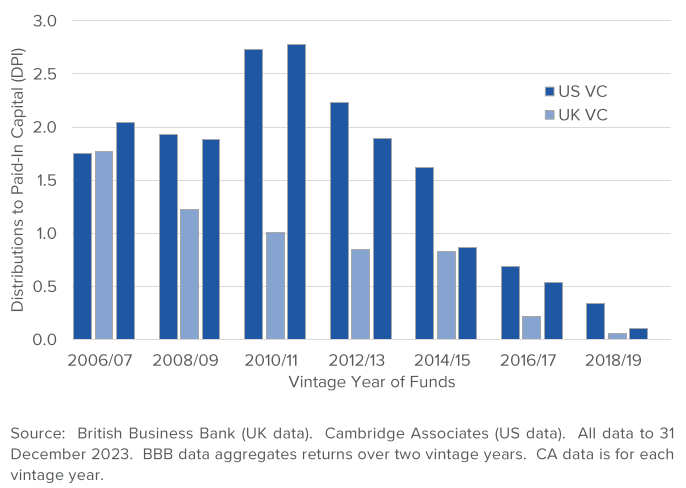

This underperformance in generating exits can also been seen when comparing the performance of the UK VC industry to that of the US. Figure 4 below shows just how much the UK trails the US when it comes to delivering realised gains back to investors.

Figure 4: UK vs US Realised Performance

To understand why the UK VC industry has historically struggled to deliver realised returns to investors, it is essential to appreciate the power-law nature of venture capital.

4. HOW VC GENERATES RETURNS

Venture capital is a power-law asset class. There are two main characteristics of a power-law distribution of returns:

- The vast majority of investments underperform or actually lose money for investors.

- The overall performance of the asset class is driven by a very small percentage of highly successful investments.

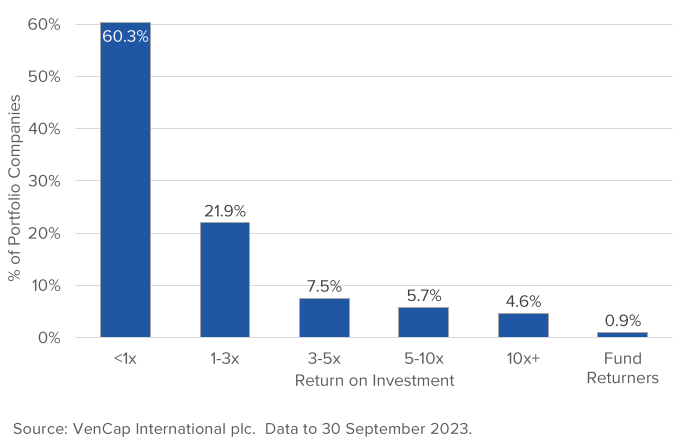

VenCap has analysed over 200 early-stage venture funds raised between 1995 and 2015. These funds invested in more than 9,000 portfolio companies. Figure 5 below shows the return distribution of these 9,000 plus companies. Over 60% of these investments have generated a negative return for their investors. In contrast, just 4.6% of companies generated 10x cost or higher and just 0.9% achieved the mythical “fund returner” status (ie returned more than 100% of the total capital of the investee fund).

Figure 5: The VC Power Law

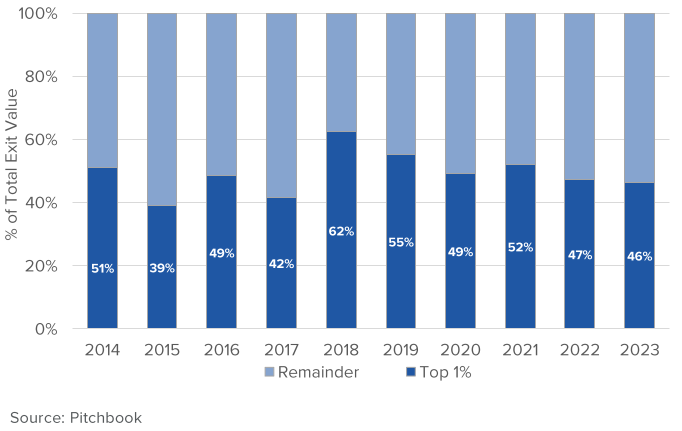

In order to compensate for the high percentage of underperforming investments, the VC industry requires the small number of successful companies to generate wildly outsized returns for their investors. Over the last decade, the top 1% of VC-backed exits (on average 33 companies each year) have generated approximately 50% of the total exit value created by the venture capital industry globally.

Figure 6: Top 1% of VC Exits

Since 2014, the median value of a top 1% exit has been $4.3 billion, while the average value is $8.3 billion. This is the level of ambition that UK companies need to show if they are to compete successfully with the very best venture-funded businesses globally. According to Pitchbook, there are only six UK VC-backed companies, founded in the last 20 years, that have exited at a value above $4.3 billion and just two (Wise and Deliveroo ) that have exceeded $8.3 billion. If the UK VC industry wants to deliver realised performance that matches or exceeds that of the US, then we need to see many more companies that are capable of emulating the likes of Wise and Deliveroo. Without these outsized outcomes, the UK VC industry will always struggle to provide investors with the returns they are targeting from the asset class.

However, it is not enough for the VC industry overall to produce strong performance. UK investors must also understand how to capture this performance through their individual investment strategies.

5. YOU CAN’T INDEX THE VC MARKET

In an asset class with a normal distribution of returns, a relatively small sample of investments is all that is required to replicate overall industry performance. Unfortunately, for a power-law asset class, where a small number of successful outcomes drive overall performance, it is much more challenging for investors to match the overall industry return.

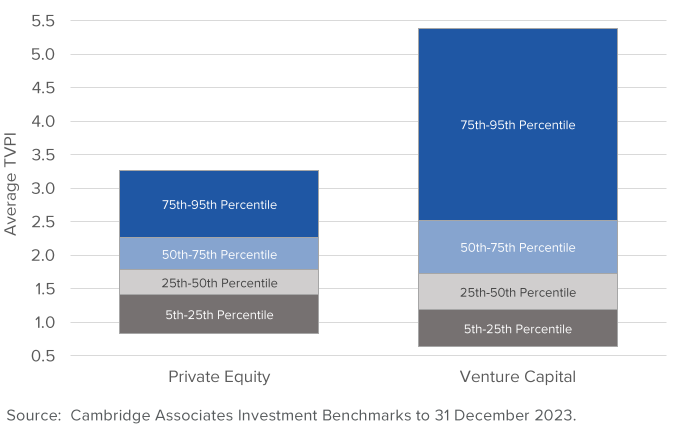

The gap between the performance of the best venture funds in any given vintage and the worst is much wider than for most other asset classes. Figure 7 below shows the average percentile boundaries for both private equity and venture capital for funds raised between 2000 and 2019. The average VC fund (represented by the median) returns just 1.7 times cost and an IRR of less than 10%. It’s only by consistently accessing the very best VC funds (top quartile} that investors can start to generate the type of performance that can justify the risk and illiquidity.

Figure 7: Average Percentile Boundaries (2000-2019)

The challenge, then, for UK pension funds looking to build a venture capital investment programme is simple. How can you develop an investment strategy that enables you to consistently access top-quartile funds?

The good news is that within venture capital, the past performance of a VC firm is a fairly reliable indicator of future performance. Academic studies have shown that 45% of managers whose prior fund ranked in the top quartile will also deliver top-quartile performance with their subsequent fund. For private equity, this figure falls to just 33%.

The reason why persistence of performance exists within venture capital is due to the power law nature of investment outcomes. If a VC firm has the good fortune to be an early investor in a top 1% company, they can then leverage this success to increase their chances of finding more top 1% outcomes. There are several ways in which this happens:

- Improvement in deal flow. Being closely associated with a highly successful company will build a firm’s brand and can result in a higher quality of deal flow. It also allows firms to tap into the personal deal flow of successful founders.

- Better pattern recognition. Once a firm has worked with a world-class founding team, they are more likely to recognise the required characteristics from future entrepreneurs they are looking to back.

- Winning competitive deals. Founder references play a crucial role in helping VC firms win competitive deals. Having a highly successful entrepreneur acting as a reference can be a huge advantage.

- Adding value. The stronger a VC’s brand, the more of a halo effect it has on their portfolio companies. Being funded by a toptier VC can have a huge impact on a company’s ability to attract the best talent and raise future capital.

Over time, we have seen a small group of VC firms emerge that have been able to compound these advantages over multiple funds and create a virtuous flywheel. Each top 1% company they back gives them an even better chance of investing in the next breakthrough opportunity. This ultimately results in a concentrated group of VCs that can consistently outperform and deliver top-quartile returns to their Limited Partners.

6. CONCLUSION

Investing in venture capital is difficult. The vast majority of VC-backed companies lose money for their investors and most VC funds fail to produce acceptable risk- adjusted returns.

However, there are a small number of companies and VC funds that are able to buck this trend. If UK pension funds want to build a VC programme that is capable of consistently increasing returns for UK workers, then they must find a way of accessing the top 1% of exits. For now, the reality is that the vast majority of these top 1% exits come from companies based outside of the UK.

We believe that the best way for UK pension funds to profitably increase their exposure to high-growth companies is by. building a programme that concentrates capital into the small group of top-tier VC firms globally. These are the firms that have consistently been able to back the very best companies.

Over time, we hope that more of these firms will open offices in the UK and will deploy more of their capital into UK companies. We have already seen the likes of Accel, Andreessen Horowitz, General Catalyst, Index, Lightspeed and Sequoia open offices in London and have permanent teams on the ground in the UK.

Within the VC industry, we believe capital will always be attracted to the best opportunities, wherever they may be located. If the UK wants to increase its share of VC investment capital, then we need to see more UK companies achieving “fund returner” status and delivering top 1% exits to their investors.

This content is provided for informational purposes only, and should not be relied upon as advice.