OVERVIEW

It is clear that the VC industry is going through a period of significant change. After hitting record highs in 2021/22, VC fundraising, investment and liquidity have all fallen significantly as the industry resets itself back to more sustainable levels. In particular:

- 2024 saw a flight to quality, with LPs concentrating capital into a small number of experienced and proven VC firms.

- The VC power law is starting to reassert itself with the very best companies able to raise new rounds at increased valuations.

- While the liquidity environment is improving, we expect exit value will be highly concentrated in a relatively small number of large outcomes.

- There will be greater variation in the performance of individual VC funds. The ability to select and access the best managers will be the key driver for LP performance.

2024 OVERVIEW

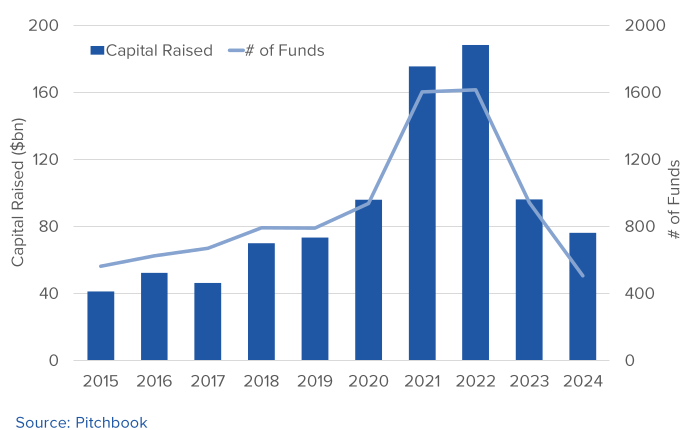

2024 was a year of consolidation for the US VC industry, with capital being concentrated into a handful of VC firms and into a small group of companies. Just over 500 VC funds closed on $76 billion of commitments in 2024. This represents a 21% fall in dollars raised compared to the prior 12 months, but a reduction of nearly 50% in the number of funds closing.

Figure 1- US VC Fundraising

There was a marked flight to quality amongst Limited Partners, with just 10 VC firms accounting for nearly half of all capital raised. Three firms—Andreessen Horowitz, General Catalyst and Thrive Capital—each raised more than $5 billion and collectively represented almost a quarter of total VC fundraising.

Fundraising for emerging managers proved exceptionally difficult, with established-manager funds exceeding the number raised by emerging managers for the first time in a decade. The number of new first-time funds fell by more than 75% from the highs of 2021. According to a report from Stepstone, nearly half of first-time managers that raised a fund in 2019 have failed to raise a successor fund.

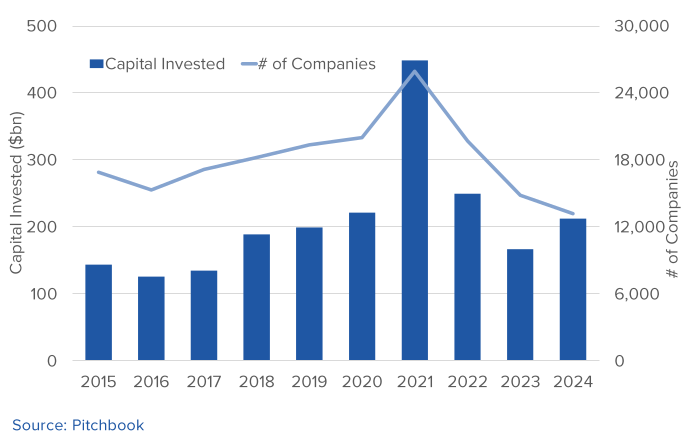

After a fall in 2023, investment in US VC-backed companies rebounded in 2024, with just over 13,000 companies raising $213 billion. Capital invested increased by 27.5% over the prior 12 months, however the number of companies closing new rounds actually fell by 11%.

Figure 2: Investment in US VC-Backed Companies

There were 30 companies that each raised $500 million or more during 2024. Collectively, these 30 1600 companies accounted for 31% of total invested dollars during the year. xAl raised $12.1 billion, Anthropic $9.2 billion and OpenAl $6.6 billion as VCs scrambled to get access to the leading Al-related companies. In total, Al-800 related companies accounted for more than 45% of total capital invested, despite representing less than 29% of total deals.

Figures 1 and 2 show that both fundraising and investment levels have corrected materially from the highs in 2021 and 2022. However, this does not mean that all the excesses from those years have worked their way through the system.

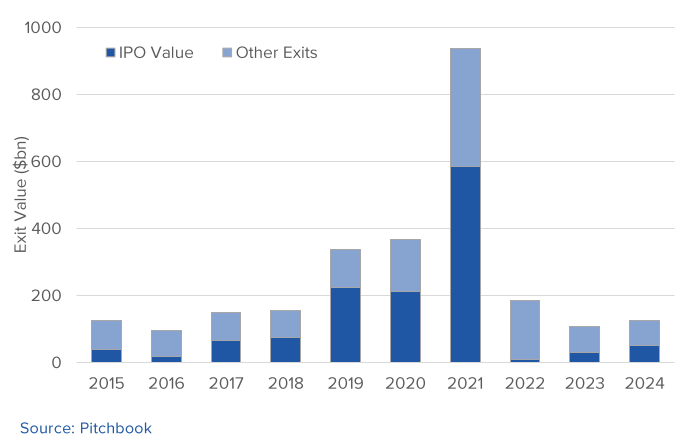

LIQUIDITY REMAINS CHALLENGING

After a record-breaking year for liquidity in 2021 with US VC-backed companies generating nearly $1 trillion of exit proceeds, the IPO and M&A markets slammed shut. The next three years combined generated less than 45% of the exit value created in 2021. Many LPs are dependent on distributions to fund future VC fund commitment. With a paucity of exits over the last three years, it’s little surprise that fundraising levels have dropped materially and that LPs have prioritised a small group of managers that have been able to generate material DPI for them.

Figure 3: US VC-Backed Exit Value

The lack of liquidity from the venture industry over the last three years is not due to a lack of companies that are IPO ready. Pitchbook estimates that VC-backed unicorns now account for $4.6 trillion in value, with many of them more than able to go public if they chose. Companies like SpaceX, OpenAl, Stripe and Databricks are each generating more than $1 billion in revenue and have all raised substantial private capital in the last 12 months. While all are possible 2025 IPO candidates, they may equally elect to continue to grow in private. Behind these four companies there are companies such as Revolut, Wiz, Anduril, Scale Al, Rippling, Devoted Health and Figma that all raised capital in 2024 at valuations in excess of $10 billion.

While we are cautiously optimistic that we will see the IPO market improving in 2025, prospects for increased M&A remain uncertain. With the removal of Lina Khan as FTC Commissioner, we would expect a more relaxed regulatory approach to M&A activity. However, we would still expect any deal involving one of the large tech incumbents to attract close scrutiny.

With continued uncertainty around major liquidity events via IPO or M&A, we expect to see VCs continue to explore more unconventional routes to generate liquidity. In 2024, a number of VCs initiated GP-led secondaries. This involves GPs transferring portfolio companies into a continuation vehicle and giving LPs the option to roll their investments into this new entity or sell (usually at a discount) to a secondary buyer. We would expect to see more of these transactions come to market in 2025, particularly for emerging managers looking to raise new funds with little prospect of traditional liquidity events for their portfolio.

We also expect to see significant activity continue for LP-led secondaries as investors look to rationalise their VC exposure. Both GP-led and LP-led secondaries can provide attractive investment opportunities for investors with the knowledge to accurately assess the underlying assets and the capital to participate in such transaction.

WHAT SHOULD LPs EXPECT GOING FORWARD?

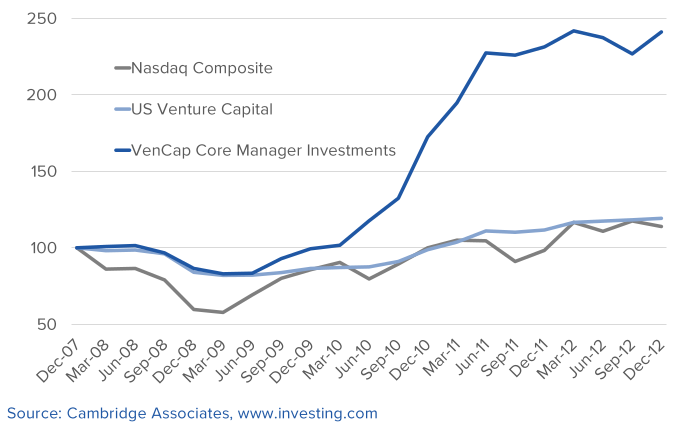

We believe that the period immediately after the 2008 Financial Crisis provides a good indication of what LPs should expect to see from the VC industry over the next 2-3 years. In particular, there are four key developments that we expect to emerge:

- There will be fewer exits from VC-backed companies, however the size of these exits will increase.

- This will drive greater divergence between the performance of individual venture funds. Those funds with access to the small number of winners will strongly outperform.

- Average VC industry performance is likely to be muted as we are yet to see extinction events for many of the companies funded at the top of the market.

- LP returns for the 2015-2021 vintages will be largely driven by the quality of their manager selection.

We are already seeing a concentration of capital in the private markets into a relatively small number of companies. This flight to quality is an early indication of what we should expect to see from the exit markets over the next couple of years. The best companies quickly pivoted from a “growth at all costs” mentality to reduce their cost basis and improve capital efficiency. This meant that they were able to successfully navigate the market downturn and emerge in a much stronger competitive position. This is now being reflected in the valuations they have been able to achieve as they raised new capital in 2024. Recent examples of this include the following:

The return distribution of VC funds is driven by the power law nature of investing in startups. As can be seen in Figure 2 below, around 60% of early-stage, VC- backed companies ultimately fail to return cost back to their investors, with 27% of companies being complete write-offs.

Raised $10 billion at a $62 billion post-money value in December 2024. Expected to hit $3 billion in annualised revenue in most recent quarter and growing 60% pa. Andreessen Horowitz led the company’s A Round.

Closed $300m secondary round at a $12 billion post-money value in February 2025. Hit $800 million in annualised revenue and grew by 70% year-on-year. Spark Capital and Andreessen Horowitz were early investors in the company.

Raised $1 billion at a $14 billion post-money value in May 2024. Expected to hit $1.4 billion in ARR at the end of 2024, growing by 200% annually. Accel Partners and Index Ventures were early investors.

The last time we saw a similar consolidation of the VC industry was after the Financial Crisis in 2008/09. We believe the aftermath of this downturn provides the best guide for what we can expect over the next few years. As shown in Figure 4 below, we saw our Core Manager funds significantly outperform the VC industry from 2009-2012 as markets recovered from the market downturn.

Figure 4: Core Managers Outperform Post Correction

SUMMARY

We believe that the VC industry is part-way through a major consolidation. It is clear that too many VCs and too many companies were funded at the top of the market and we have not yet seen the full extent of the correction.

The next few years are likely to see a marked divergence in the performance of the best VC funds and the rest of the market. Average VC returns for the foreseeable future may not be attractive. But VC is not about averages. It’s about outliers. And there is clear evidence that the very best VC-backed companies are emerging strongly from the last few years, growing revenues quickly (and with much better unit economics) and reaching substantial scale.

While we cannot predict the exact timing of the IPO window opening, we would expect to see multiple companies listing at valuations in excess of $10 billion over the next few years. This will deliver strong realised returns for the small group of VC firms that have built up meaningful holdings. Those LPs with access to these firms will generate strong performance.

Venture capital has always been a power-law asset class, with a small number of companies delivering the bulk of returns to investors. We believe the next few years will once more reinforce this fundamental truth.